Read summarized version with

Founded in 2013, Swiss Beauty is an Indian brand offering high-quality products. They began with a single kajal and a simple goal: to make high-quality beauty products accessible to Indian consumers.

Over the next 12 years, the brand quietly scaled to:

- 1,500+ SKUs across makeup and skincare

- ₹425 crore in annual revenue

- Zero external funding

- A projected ₹700–1,000 crore target by FY2026

Swiss Beauty didn’t grow by chasing luxury cues or influencer hype early on. Instead, it focused on fundamentals most brands overlook.

What Made Swiss Beauty Simple Marketing Strategies Work?

Strategy 1: Omnichannel Distribution: Choosing Offline When Online Was the Obsession (2013–Present)

In the early 2010s, most new beauty brands were busy positioning themselves as D2C-first. Swiss Beauty went in the opposite direction.

The brand focused on traditional retail at a time when going online-only was being sold as the smarter, faster path. Instead of prioritizing clicks, it prioritized counters.

That meant:

- Building distribution across 25,000+ physical retail touchpoints.

- Focusing heavily on Tier II and Tier III cities, not just metros.

- Opening 12 Exclusive Brand Outlets in cities like Chandigarh, Udaipur, Lucknow, Pune, and Kolkata

This worked mainly because of timing. In 2013, Indian beauty consumers were still predominantly offline shoppers. Tier II and III markets also had less clutter and higher loyalty. Physical presence helped Swiss Beauty build Trust Early, something many online-first brands struggled with later.

Today, numbers show that:

- 55% of revenue comes from offline retail

- 40% from online marketplaces such as Nykaa, Purplle, Amazon, Myntra, and Flipkart

- Just 5% from the brand’s own website

Regionally, revenue is split almost evenly between Tier I and Tier II cities, with Tier III contributing a meaningful 20%. Jaipur and Indore remain among the top-performing markets.

Offline wasn’t a compromise. It was the foundation.

A Timely Move to Digital (2019–Present)

As smartphone adoption accelerated and e-commerce became mainstream, Swiss Beauty expanded its digital footprint. This is the timeline:

- 2019: Entry into online marketplaces during the e-commerce growth phase

- 2021: Launch of the brand’s D2C website

- 2022: Partnership with 3PL provider Emiza to strengthen warehousing and logistics

- 2024: Integration with quick commerce platforms, including Blinkit, Zepto, and Instamart

Today, Swiss Beauty maintains a presence on 17+ e-commerce and quick-commerce platforms, ensuring accessibility across consumer touchpoints as purchase behavior continues to fragment.

Strategy 2: User-Generated Content as a Trust Multiplier

Swiss Beauty leveraged user-generated content to build credibility at scale.

In beauty, trust is created when consumers see products perform in real conditions. Swiss Beauty enabled this by allowing real users to demonstrate shade payoff, texture, and wearability through everyday formats such as swatches, GRWM routines, wear tests, and before-and-after videos.

The brand focused on nano and micro creators to preserve relatability, particularly in Tier II and Tier III markets where peer validation outweighs aspirational imagery. Professional makeup artists added credibility, while everyday users reinforced authenticity through lived experience.

High-performing UGC was amplified through paid media rather than replaced with studio-led creatives. This ensured consistency between organic discovery and paid reach, while maintaining the realism that drives conversion.

Strategic Outcome

UGC reduced uncertainty in the buying journey and strengthened confidence at the point of purchase across social platforms and marketplaces.

Key Insight

- Trust scales fastest when consumers see the product in action.

- Swiss Beauty lets proof do the marketing.

Strategy 2: Brand Positioning: Making Aspiration Accessible to Gain Acceptance

“Every brand has a story” is easy to say. Living it is harder.

But Swiss Beauty’s proved this with one clear idea: Beauty for Every You. In practice, that means products that look premium, perform well, and are priced far below what the category typically charges. (They did in the Beauty Industry what Dove did in the Skincare Industry)

The brand didn’t try to imitate luxury. It focused on value.

Some takeaways:

- Premium-looking products are typically priced between ₹400 and ₹500.

- Shade ranges explicitly designed for Indian skin tones.

- Vegan, cruelty-free, PETA-certified formulations.

- Products tested for Indian weather and long-wear conditions.

The core audience has consistently been Gen Z and millennials, with a strong skew towards value-conscious consumers in Tier II and III cities.

Strategy 3: Product Innovation, the Key to Staying Relevant with Time

Swiss Beauty’s product strategy has focused less on novelty and more on relevance, and rightly so. From launching a single kajal in 2013, the brand has grown its portfolio to over 1,500 SKUs spanning face makeup, eye makeup, lip products, and skincare.

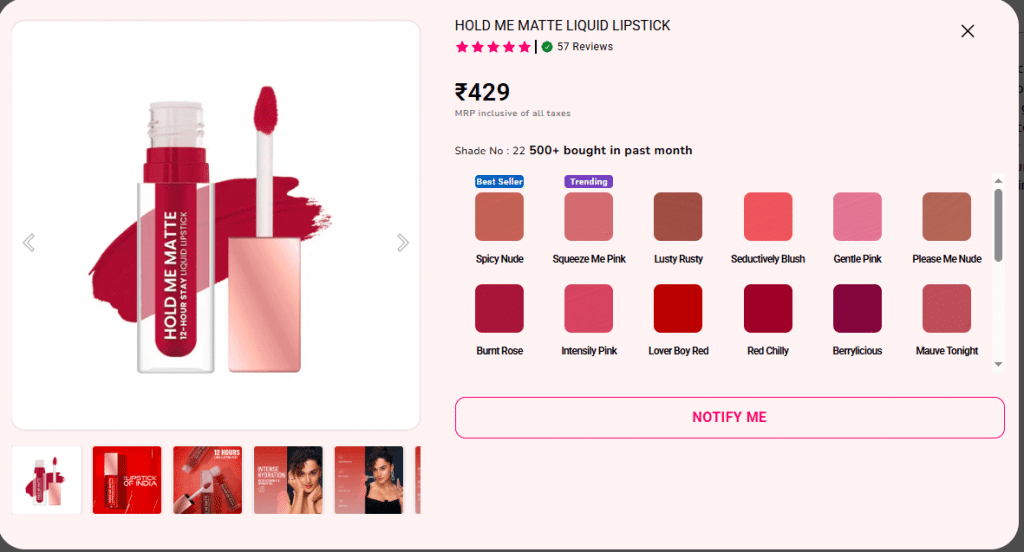

Innovation, when introduced, has been purposeful and accessible. In 2024, Swiss Beauty launched India’s first holographic eyeliner at ₹449, priced at roughly the cost of two cups of coffee. The brand was also the first in India to introduce a dual-colored eyeliner. Additionally, its Hold Me Matte liquid lipstick range, now positioned as The Lipstick of India, was launched in 30 shades explicitly curated for Indian skin tones. To further lower entry barriers, Swiss Beauty introduced mini and trial packs, encouraging first-time users to experiment with the brand.

Most importantly, product development is tailored to Indian skin tones and climate conditions, a pain point many global brands have fallen short on.

The portfolio is further strengthened through precise sub-brand segmentation:

- Swiss Beauty Select, a more premium, skincare-infused range exclusive to Nykaa

- Swiss Beauty Craze is targeted at younger consumers.

Strategy 4: Portfolio Growth Through Innovation and Strategic Timing

As Theodore Levitt observed, “Creativity is thinking up new things. Innovation is doing new things.” Swiss Beauty’s portfolio growth reflects this distinction, driven by steady execution and relevance rather than constant novelty.

Portfolio Evolution

- 2013: Launched with a single SKU (kajal)

- 2024: Expanded to 1,500+ SKUs across face makeup, eye makeup, lip products, and skincare

Key Innovation Milestones

- India’s first holographic eyeliner, launched at ₹449

- “Hold Me Matte” liquid lipstick, positioned as The Lipstick of India, with 30 shades tailored to Indian skin tones.

Timing Matters: A Phased Growth Journey

Carefully sequenced strategic moves have supported Swiss Beauty’s portfolio expansion:

| Year | Milestone |

| 2013 | Brand founded; first product launched. |

| 2013-19 | Built 25,000+ offline retail touchpoints. |

| 2019 | Entry into online marketplaces. |

| 2021 | D2C website launched. |

| 2022 | Logistics partnership with Emiza. |

| 2023 | Celebrity endorsement: Taapsee Pannu onboarded. |

| 2023-24 | Don’t Be a Star, Be a Trendstar campaign |

| 2024 | Swiss Beauty Select launched (Nykaa exclusive) |

| 2024 | Quick-commerce integration (Blinkit, Zepto, Instamart) |

| 2024 | Achieved 100% YoY revenue growth |

| 2025 | Targeting ₹700 crore in revenue |

Strategic Insight: Credibility Before Visibility

By delaying celebrity endorsement for nearly a decade, Swiss Beauty ensured that visibility followed credibility. When Taapsee Pannu joined, the brand already had strong distribution, consumer trust, and demand, allowing endorsement to serve as an accelerator rather than a substitute for brand equity.

What This Tells Us So Far?

Swiss Beauty’s growth wasn’t built on viral moments alone. It was built on:

- Being present where consumers actually shop

- Offering aspiration without alienation

- Letting products prove their value in real life

In the next section, we’ll look at how this strategy translated into campaigns that didn’t just look good, they performed.

Campaign Masterstrokes: What Set the Brand Apart from Its Competition

Swiss Beauty’s campaigns focus on being real, featuring real people and practical, everyday solutions. It’s not just big talk; the work is done, shown, and executed to demonstrate their unquestionable value. From the very beginning of product development, they focus on their products, which is why shelves empty and the brand achieved 100% year-on-year growth.

1. A Standout Campaign: “Har Bride Ka Beauty Stroke”

The Idea: A bride applying makeup in a car. Getting ready outside the stadium. An influencer dressed as a bride. Creative? Yes. But even the most out-of-the-box idea only works if it’s seen. Visibility is everything, and the bigger the stage, the better.

Execution:

- Makeup is applied to the influencer while she is in a moving car. Unusual, unexpected, and attention-grabbing.

- Cricket-style commentary was added as narration to enhance cultural relevance.

The bride walked through IPL stadium security, endured curious stares, and navigated packed, humid crowds, all live, in front of thousands.

The Test:

A very public reality check: Does the makeup last under real-world conditions?

Why It Worked:

- Confidence to let the product be tested in public: hours of wear, movement, sweat, and scrutiny.

- In a category obsessed with flawless visuals, real performance stands the heat (quite literally).

- Credibility through transparency; consumers saw the product perform, not just told it works.

Key Insight:

The masterstroke wasn’t the idea itself; it was letting the product prove its claims, without protection. Reality checks, take a bow.

2. Bridal Bundle Campaign: “Har Bride ka Beauty Bundle.”

The Idea:

India hosts roughly 10 million weddings every year, making the bridal segment a vast market. Swiss Beauty leveraged this with a campaign targeting brides and their close circles, featuring curated bridal kits and digital content. The focus: real people, real occasions, and practical solutions for wedding makeup. Creative? Absolutely Yes!

Execution:

- Dedicated bridal bundles were launched, such as Wedding Shagun Kit, Modern Rani Vanity, and Modern Rani Pouch, designed for different wedding ceremonies (haldi, mehendi, sangeet).

- YouTube tutorials and social content showed step-by-step bridal looks, honest product reviews, and tips for brides and BFFs.

- Campaign content highlighted friends, bridesmaids, and grooms, making the experience inclusive and culturally relatable.

- Playful, on-brand language (e.g., “You & Eye for eye-makeup”) reinforced Swiss Beauty’s personality.

The Test:

Reaching brides digitally through YouTube and social campaigns, the brand gauged engagement, tutorial views, and kit sales to see if their content translated into real-world adoption for weddings.

Why It Worked:

- Tapped into a massive, recurring wedding market (10M weddings annually).

- Culturally relevant content ensured resonance across diverse audiences.

- Combined content + commerce, letting consumers see tutorials and buy kits immediately.

- Addressed both bride’s and groom’s needs, expanding relevance beyond traditional female-focused marketing.

Key Insight:

The masterstroke was integrating real wedding scenarios, digital tutorials, and curated kits to make products tangible and usable.

3. Valentine’s Day Campaign: Swiss Beauty CRAZE – AI Rap Anthem

The Idea:

For Valentine’s Day, Swiss Beauty CRAZE leaned into two things Gen Z loves: AI and rap. Instead of a typical love-led campaign, the brand flipped the narrative to focus on self-love, individuality, and main-character energy.

Execution:

- An AI-generated rap anthem was created, designed to make viewers feel like the protagonist of their own story.

- The campaign featured four distinct personality types, allowing consumers to see themselves represented and identify with their “tribe.”

- The content was rolled out primarily on Instagram Reels, tapping into Gen Z’s preferred format and consumption habits.

The Test:

Could a tech-forward, personality-led campaign break through seasonal clutter and resonate with a Gen Z audience saturated with Valentine’s Day messaging?

Why It Worked:

- Strong audience insight–led execution, rooted in Gen Z’s interest in AI, music, and self-expression.

- Shifted Valentine’s Day messaging from romance to self-love and individuality, making it more inclusive.

- Reinforced CRAZE as a trend creator, not just a trend follower.

Key Insight:

The masterstroke was using technology and music not as gimmicks, but as tools to reflect identity. It sold a feeling of being seen.

4. Brand Campaign: “Don’t Be a Star, Be a Trendstar.”

The Idea:

In a category dominated by aspirational perfection, Swiss Beauty chose a different route. “Don’t Be a Star, Be a Trendstar” was built on the belief that beauty is about self-expression and creativity, not chasing flawless ideals. The campaign encouraged consumers to own trends rather than follow them.

Execution:

- Taapsee Pannu was signed as the brand ambassador—relatable, expressive, and well-aligned with Gen Z and millennial audiences.

- Campaign films and digital content highlighted individuality, confidence, and trend-led beauty over traditional glamour.

- The messaging was rolled out across Instagram, YouTube, OTT platforms, retail POS, and online marketplaces, ensuring wide visibility and consistency across touchpoints.

The Test:

Could a shift from celebrity-led aspiration to personality-driven expression resonate with a young, trend-aware audience?

Why It Worked:

- Taapsee Pannu’s persona reinforced authenticity rather than unattainable perfection.

- The campaign aligned with evolving consumer attitudes that value expression over validation.

- A strong omnichannel rollout ensured the message reached consumers at the discovery, consideration, and purchase stages.

- Positioned Swiss Beauty as a trend enabler, not just a cosmetic brand.

Key Insight:

The masterstroke was reframing aspiration. By celebrating individuality over stardom, Swiss Beauty made trend ownership feel accessible and aspirational in a new way.

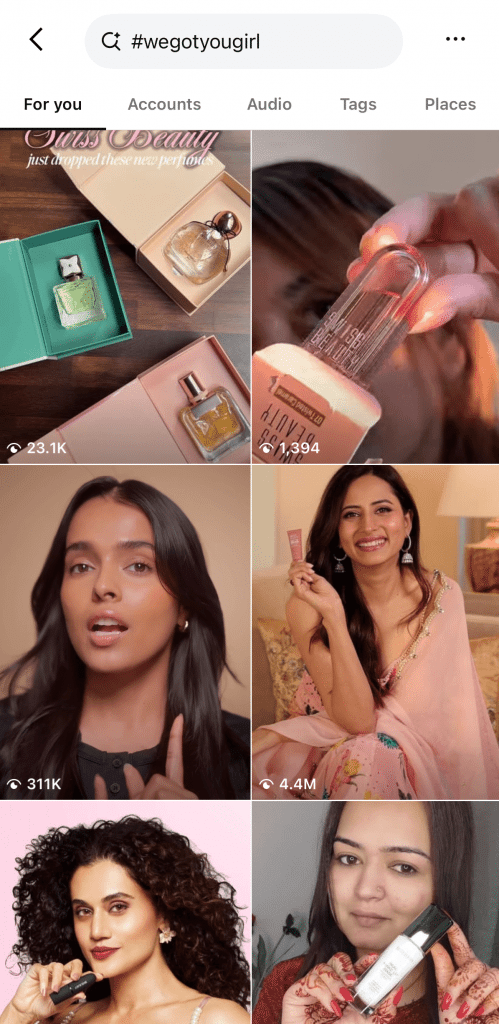

5. Brand-Level Community Campaign: #WeGotYouGirl

While individual campaigns helped Swiss Beauty showcase product performance and trend relevance, the brand also built a larger, unifying narrative around emotional support and relatability.

In a category that often amplifies perfection, pressure, and unrealistic beauty standards, Swiss Beauty chose a simpler message: we’ve got you.

#WeGotYouGirl emerged as a community-led brand campaign rooted in reassurance rather than aspiration. It reinforced Swiss Beauty’s long-standing belief that beauty should feel supportive, inclusive, and judgment-free; not intimidating or exclusive.

The Idea:

Beauty is not about meeting expectations. It’s about showing up as you are, experimenting freely, and feeling confident in your own skin.

Execution:

The campaign was woven organically into Swiss Beauty’s digital ecosystem rather than launched as a standalone burst.

- Real users and creators shared everyday beauty moments, not overproduced transformations.

- Content focused on confidence, self-expression, and small wins rather than flawless outcomes.

- The hashtag appeared consistently across Instagram Reels, Stories, and creator collaborations, acting as a recurring emotional cue rather than a campaign slogan.

Why It Worked:

- Aligned seamlessly with Swiss Beauty’s product-led credibility and value-first positioning.

- Strengthened emotional trust without shifting focus away from performance.

- Integrated naturally with UGC and influencer content, making it feel authentic rather than scripted.

- Allowed multiple campaigns and product launches to sit under one consistent emotional umbrella.

Key Insight:

#WeGotYouGirl didn’t try to create a moment. It created continuity.

By standing with its consumers instead of selling to them, Swiss Beauty turned a hashtag into a long-term brand signal of trust and belonging.

How Swiss Beauty Builds on Community‑Driven Marketing?

1. Objective

Goal: Understand how Swiss Beauty has built a scalable marketing engine that combines content, influencers, UGC, paid media, and retail to drive growth.

Key philosophy:

- Discovery > direct selling

- Relatable content > polished perfection

- Community-driven content builds trust

2. The Beauty Buying Journey

Swiss Beauty aligns marketing with the typical beauty purchase journey:

| Stage | Consumer Action | Swiss Beauty Approach |

| Discovery | Social media exploration | Instagram content, creator collaborations, UGC. |

| Research | Product reviews, tutorials | YouTube tutorials, swatches, step-by-step content. |

| Purchase | Website or marketplace | Easy checkout, bundles, multiple payment options. |

3. Content & Social Media Strategy

Instagram as a Digital Showroom

- Focus on visual clarity: shade accuracy, texture, real results

- Top formats: before/after, swatches, tutorials, creator demos

Repeatable Content Formats

- GRWM videos

- Step-by-step tutorials

- Unboxing

- Affordable dupes

- Before/after transformations

Influencer Strategy

- Nano creators: authenticity & engagement

- Micro creators: trusted reach

- Makeup artists: professional credibility

UGC Strategy

- Central to the marketing ecosystem

- Builds trust and social proof

- Highlights product performance across skin tones and lighting

4. Paid Media Strategy

Swiss Beauty amplifies proven content rather than starting from scratch.

Channels:

- Meta (Instagram & Facebook)

- Google Search & Shopping

- YouTube

- Marketplaces

Creative Approach: Mirror organic content (before/after, tutorials, reviews) to maintain authenticity.

5. Retail & Distribution

| Metric | Current | Planned |

| Retail Outlets | 25,500+ | – |

| Exclusive Brand Outlets (EBOS) | 12 | 24 by FY25 |

| Additional Outlets | 147 beauty-assisted, plus,450+ general trade. | – |

| Tier-2 & Smart Cities Contribution | ~40% |

6. Skincare Vertical

- Current SKUs: 10 live, 10–15 more planned

- ARR target: ₹600 cr in 5 years

- Distribution target: 50,000 outlets

- Year-end revenue share: ~5%

7. Key Takeaways for Marketers

- Discovery drives more impact than direct selling.

- Relatable content is more effective than over-stylized visuals

- Community-driven content (UGC + influencers) scales trust

- Paid media amplifies authenticity

- Multi-channel orchestration (social + e-commerce + retail) delivers measurable growth

Let’s look into the details regarding this case study:

Swiss Beauty – Glitter Lipstick Launch Case Study

This case study aims to capture Swiss Beauty at its strongest. It illustrates how Swiss Beauty translates trend-led insights, community-driven content, and phased execution into a successful product launch. It demonstrates how the brand captures global beauty trends and makes them accessible for Indian consumers.

Product Overview

Product Line 1: More Than Glitter Lipstick

A bold, high-impact glitter lipstick designed for statement looks.

- Texture: Creamy, lightweight

- Finish: Bold colour with visible glitter

- Benefits: Hydrating, comfortable wear

- Positioning: “More than ordinary” — made for standout glam

- Target Consumer: Bold, expressive makeup users seeking party-ready looks

Product Line 2: Glitter Color Change Gel Lipstick

A personalised glitter lipstick that adapts to the wearer’s natural lip tone.

- Innovation: pH-reactive formula creating a unique shade

- Finish: Glossy with subtle sparkle

- Benefits: Lightweight, moisturising

- Positioning: “Your unique shade of beautiful.”

- Target Consumer: Natural makeup lovers who prefer subtle glam

2. Cultural Insight: Dupe Culture and the “Dior Effect.”

By the time Swiss Beauty entered the conversation about glitter lipstick, consumer behaviour had already shifted.

Among Gen Z in particular, dupe culture has moved from being a niche internet trend to a mainstream way of discovering beauty. Shoppers weren’t starting their journey with brand loyalty; they were starting with comparison. The goal wasn’t to own luxury, it was to achieve the look of luxury, without paying luxury prices.

Platforms like Instagram and TikTok accelerated this shift. Short-form videos comparing high-end products with affordable alternatives became a dominant discovery format. A viral luxury product no longer ended the conversation; it started one. The natural next question for consumers was: What looks like this, performs like this, but costs less?

This behaviour was especially evident in the rise of luxury glitter lipsticks, most notably Dior’s, with its shiny packaging and golden crayon holder. Their high-shine finishes, dramatic sparkle, and limited-edition drops made them highly shareable, particularly around festive and party seasons. With limited people owning it, the community soon followed. In short-form video, glitter translates instantly: one swipe, one light reflection, and the product sells itself visually.

But the virality also exposed a gap. While the aesthetic travelled fast, the price point didn’t. For a large segment of Indian consumers, the desire was genuine, but the purchase barrier was too high.

That gap became the opportunity.

What emerged was a clear whitespace in the market: a glitter-forward lipstick that delivered the same visual impact, worked for Indian skin tones and occasions, and was priced at an accessible enough level to participate in the trendnot just watch it from the sidelines.

Swiss Beauty didn’t invent the trend. It recognised where the conversation was already headed and positioned itself exactly where aspiration and affordability intersected.

4. Swiss Beauty’s Competitive Advantage

Swiss Beauty was well positioned to capitalise on this trend through:

- Accessibility: Wide availability across India

- Affordability: Mass-premium pricing

- Inclusivity: Shades suited for diverse Indian skin tones

- Local relevance: Formulations suitable for Indian climate conditions

- Convenience: Availability on quick commerce platforms for last-minute party needs

Together, these factors allowed Swiss Beauty to deliver trend relevance without luxury barriers.

5. Comparative Positioning

| Attribute | Dior Glitter Lipstick | Swiss Beauty Glitter Range |

| Price | Premium luxury | Accessible mass-premium. |

| Finish | High-Impact Glitter | Bold Glitter / Subtle colour-changing glitter |

| Innovation | Visual Sparkle | Vitamin-infused / pH-reactive |

| Availability | Limited | Widely Available |

| Target Audience | Luxury Buyers | Everyday beauty customers. |

6. Launch Strategy

Phase 1: Pre-Launch Buzz

- Teaser content focused on glitter, shine, and transformation

- Influencer seeding for first impressions and authentic reactions

- Social and email countdowns to build anticipation

Phase 2: Launch Week Activation

- Coordinated rollout across Instagram, YouTube, Facebook, and Pinterest

- Reels showcasing sparkle payoff and shade changes

- Influencer-led GRWMs, swatches, and party looks

- Strong marketplace visibility on Nykaa, Amazon, and Purplle

Phase 3: Post-Launch Amplification

- UGC-led content featuring real customer looks and reviews.

- Retargeting audiences based on product views and cart activity

- Tutorial-driven content to encourage repeat usage and experimentation

7. Outcome & Brand Impact

The Glitter Lipstick launch reinforced Swiss Beauty’s positioning as:

- A leader in trend-driven, affordable beauty

- A brand that translates viral global trends for Indian consumers

- A champion of self-expression, creativity, and individuality

This launch strengthened Swiss Beauty’s role in making everyday glam accessible, without compromising on innovation or relevance.

Conclusion

Swiss Beauty’s journey challenges much of the conventional startup wisdom in the beauty industry. Its growth did not come from blindly chasing trends or following competitors’ current moves. Nor did the brand over-invest in visibility before substance existed. Instead, Swiss Beauty built patiently, layer by layer.

Think of it like an onion. The strength lies at the root. Each outer layer adds value only when the core is solid. Swiss Beauty anchored itself first in distribution, product relevance, and consumer trust, then scaled outward with marketing, innovation, and visibility.

In an industry increasingly driven by short-term virality, Swiss Beauty proves that sustainable scale still comes from fundamentals executed well. Get the basics right, and growth follows.

The lesson for modern brands is simple: when credibility leads, and marketing follows, growth becomes repeatable, defensible, and enduring.

And if that still feels too obvious, insert Keanu Reeves nodding in agreement here.